It a commonly used to evaluate a company’s liquidity position, fund its business operations and the ability to pay its short term obligations. In short it is a measure of the company’s short term health and company’s operational efficiency. A significant positive or negative change in net working capital negative change in working capital can signal potential financial challenges or opportunities and may require further analysis and management attention.

Facilitating Future Planning:

The resulting negative change in net working capital free cash flow demonstrates the importance of effective inventory management. The formula to calculate working capital—at its simplest—equals the difference between current assets and current liabilities. In financial accounting, working capital is a specific subset of balance sheet items and is calculated by subtracting current liabilities from current assets. Operating net working capital can be viewed as the amount of cash tied up in the net funding of inventory, accounts receivable, and accounts payable. As shown above a change in inventory, accounts receivable, and accounts payable results in a change in working capital and a cash flow in or out of the business.

Understanding Change in Working Capital

Because ideally, not every year, a company will get to use the supplier’s money. So this can hamper the day-to-day activities of the company and bring the operations to a halt. It can pose a serious issue if the company has had the same structure for many years. Suppose we’re tasked with calculating the net working capital (NWC) of a company with the following balance sheet data. Now, let’s move toward our final step that is the calculation of changes in working capital.

- The general rules of thumb regarding the impact of working capital changes on cash flow are shown below.

- Investors use NWC to know whether a company is liquid enough to pay off its short-term liabilities.

- Software companies generally tend to have a positive change in working capital cash flow because they do not have to maintain an inventory before selling the product.

- It’s quite easy to calculate working capital when you have already calculated total current assets and total current liabilities.

- If the change in NWC is positive, the company collects and holds onto cash earlier.

How to Calculate Change in Net Working Capital (NWC)

Negative working capital is generally only an advantage for companies with high inventory turnover. When companies are able to sell the inventory faster than they need to pay their suppliers, it is almost like getting a loan from the supplier. Negative working capital could hurt the company’s valuation and make it harder to meet financial obligations. Understanding what it means when you’re in a period of negative working capital will help you make sound financial decisions. For example, if you measure your working capital monthly, you could take your net working capital for July and subtract the net working capital for June to track the change.

The Cash Conversion Cycle Formula:

- Efficient management involves a multifaceted approach, focusing on key areas like inventory, receivables, and payables.

- For the remainder of the post, the section we will focus on is the Changes in Operating Assets and Liabilities.

- For companies with more current liabilities than current assets, the instinctual response is to interpret the negative working capital unfavorably.

- Negative working capital is when there is more short-term debt than there are short-term assets.

- To calculate our change in working capital, we will add all the items from the assets together; then, we will do the same for the liabilities.

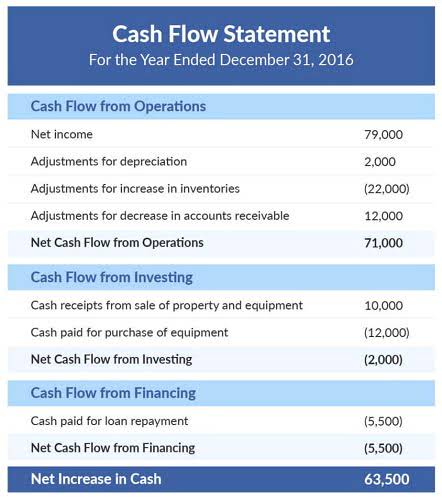

- Analyzing the change in net working capital free cash flow requires examining both the balance sheet and the cash flow statement.

Even though the payment obligation is mandatory, the cash remains in the company’s possession for the time being, which increases its liquidity. The Change in Net Working Capital (NWC) measures the net change in a company’s operating assets and operating liabilities across a specified period. The factoring company pays you right away and then waits for payment from the customer. There’s no debt or interest to pay https://www.bookstime.com/ back, so it doesn’t lower your net working capital, and you can put that money to use for your business right away.

Variance Analysis

- The relationship between working capital and free cash flow is complex, and its implications are far-reaching for financial decision-making.

- This occurs because a rise in working capital represents a larger investment in current assets like inventory or accounts receivable.

- Net working capital (NWC) is the difference between current assets and current liabilities in a company’s balance sheet.

- In this scenario, the company’s net working capital decreases, signaling potential cash flow constraints and liquidity challenges.

- This change in net working capital reduced free cash flow, hindering expansion plans.

Positive change indicates improved liquidity, while negative change may signal financial difficulties. For example, consider a manufacturing company facing challenges in collecting receivables from customers, leading to a significant increase in A/R. Meanwhile, the company experiences rapid growth in production, requiring increased inventory levels and faster payments to suppliers, causing a surge in A/P. In this scenario, the company’s net working capital decreases, signaling potential cash flow constraints and liquidity challenges. This happens when a company’s current assets (accounts receivable and cash) are lower than its current liabilities (accounts payable and short-term debt). In the cash flow financial statement, the Change in Net Working Capital (NWC) section shows how operating assets and operating liabilities change over time.

Ready to Experience the Future of Finance?

Consistent tracking of changes in working capital can be key to understanding the trend of your business’s financial health. On the other hand, negative working capital occurs when a company’s current liabilities are more than its current assets. This means that the company has less liquidity to meet its short-term obligations, leading to cash flow problems. Negative working capital can arise from various reasons such as a mismatch in payment terms with suppliers and customers, excessive inventory, or poor forecasting of cash flows. Remember that an increase in working capital reduces free cash flow, while a decrease How to Invoice as a Freelancer increases it.